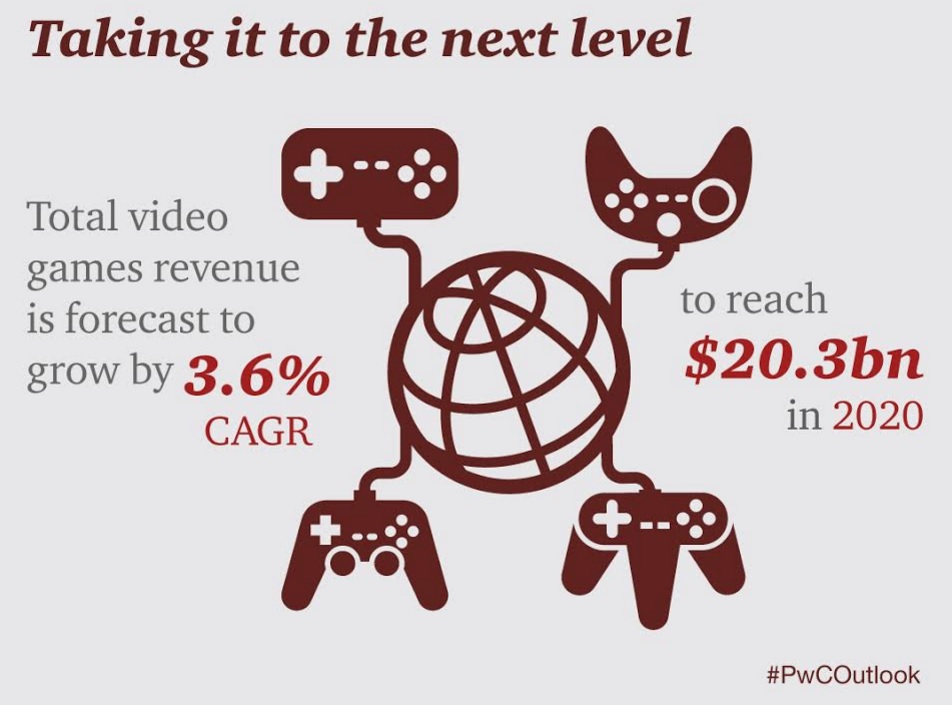

Within the global entertainment business, games look pretty good. The U.S. video game industry revenue is expected to grow at a compound annual growth rate of 3.6 percent from 2015 to 2020, according to a new report by PwC. And the global video game industry is expected to grow even faster, at a CAGR of 4.8 percent from $71.3 billion in 2015 to $90.1 billion in 2020.

Meanwhile, the U.S. entertainment industry is going to grow at a rate of about 3.7 percent per year. Video games will grow faster than other larger segments such as TV and video (growing 0.5 percent CAGR), music (3.2 percent), cinema (1.2 percent), and books (2.9 percent). But it is growing more slowly than Internet access (7.1 percent), Internet ads (9.4 percent), and out-of-home advertising (4.3 percent).

Unlock premium content and VIP community perks with GB M A X!

Join now to enjoy our free and premium membership perks.

![]()

![]()