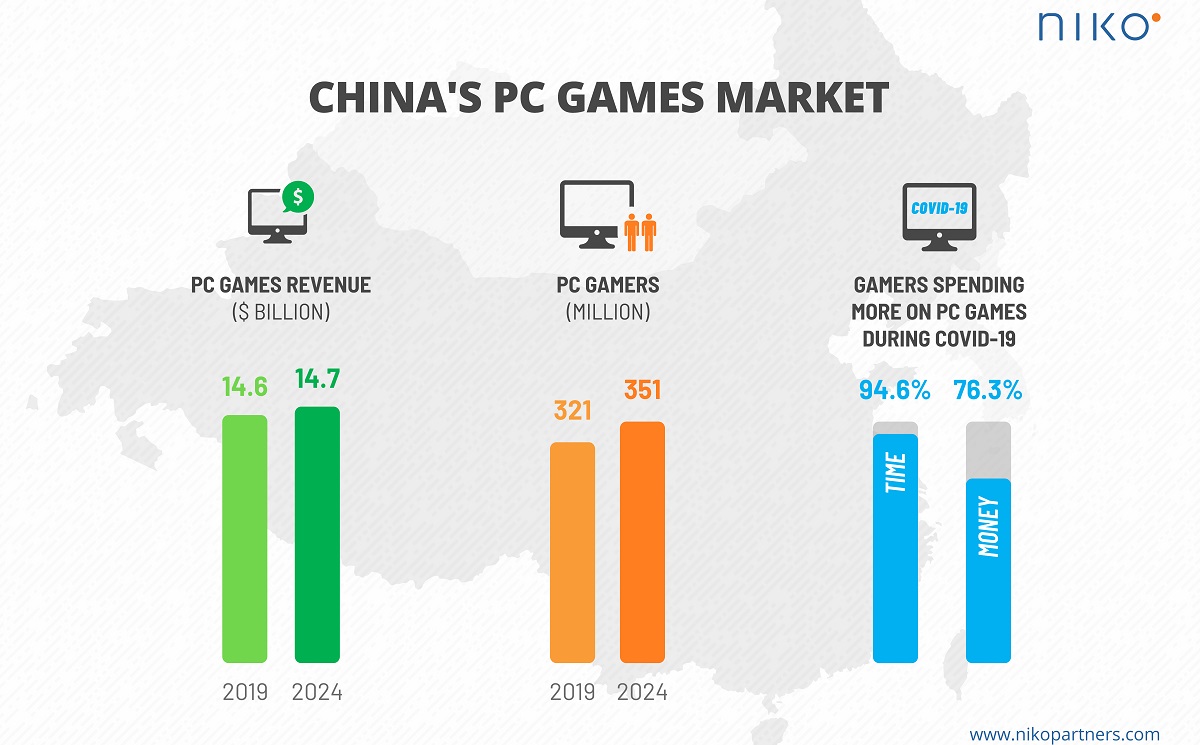

PC and mobile games revenue in China hit $33.1 billion in 2019, and it is expected to grow to $46.7 billion by 2024, according to a new reports on PC and mobile games by market researcher Niko Partners.

The new forecast takes into account the effects of the pandemic. For instance, Niko Partners now expects PC game revenues to fall 5% in 2020 as a result of the difficulties playing at internet cafes in China, but the mobile forecast has been upgraded because of higher demand, said Lisa Cosmas Hanson, in an email to GamesBeat. Cosmas Hanson moderated a panel on the pandemic’s effect on China in a panel at our recent GamesBeat Summit 2020 event.

Unlock premium content and VIP community perks with GB M A X!

Join now to enjoy our free and premium membership perks.

![]()

![]()