The CEO of any company controls the fundamental performance of their firm — revenues, costs, and hence, profitability. We work to grow our firms with a balance of upside and downside risk that we hope is optimal for our investor base’s risk-return profile. Much less in a CEO’s control, however, is what public market investors are willing to pay to own a piece of the firm’s equity.

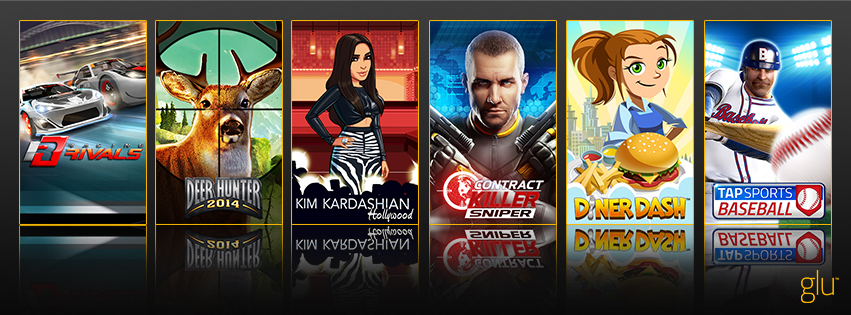

Current public-company sentiment and in turn valuations are volatile and cyclical — particularly in the macro-environment we find ourselves. King, Zynga, and Glu have all experienced some investor skepticism thus far.

Unlock premium content and VIP community perks with GB M A X!

Join now to enjoy our free and premium membership perks.

![]()

![]()