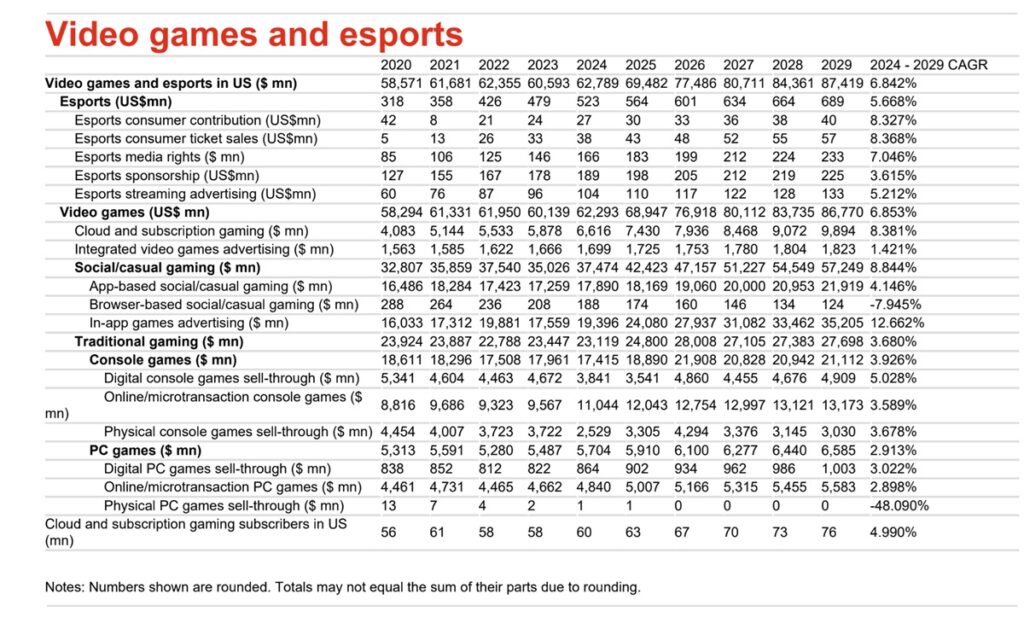

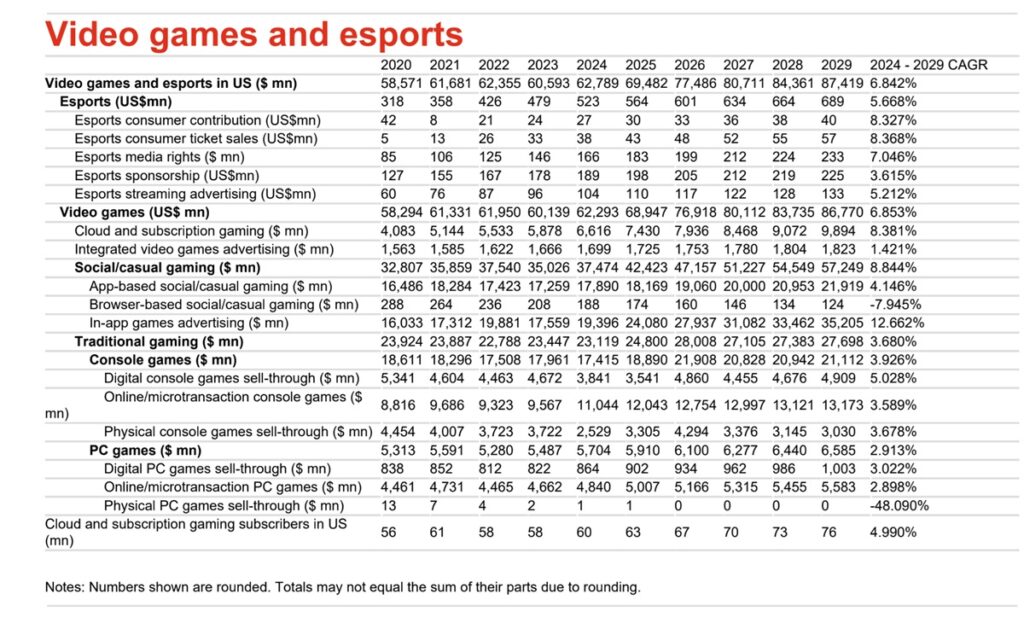

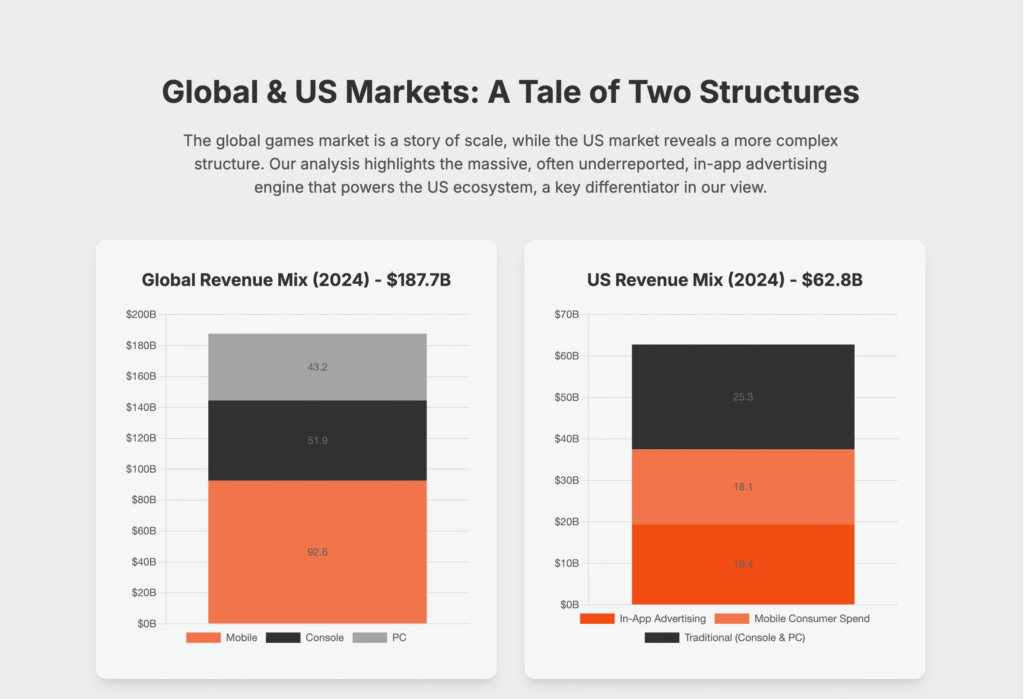

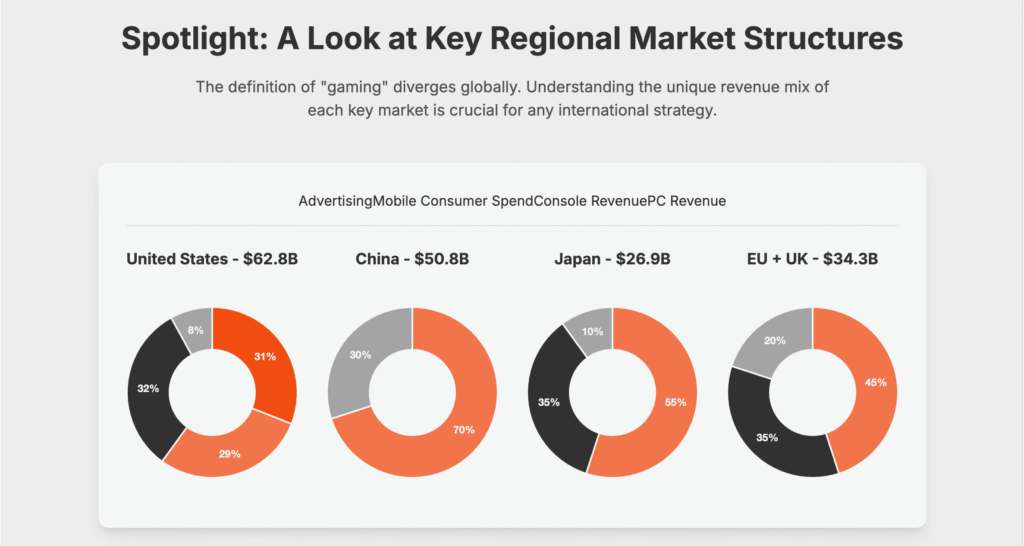

Total video games and esports revenue in the United States approached $62.8 billion in 2024, and that is expected to exceed $87.4 billion by 2029.

That will yield a 6.8% compound annual growth rate over five years, according to a new annual report by PwC. The report looks at the global market as well, which in 2024 came in at $187.7 billion, PwC said. But since the U.S. market has been suffering significant layoffs, the numbers that may be more interesting this time around are the U.S. figures.

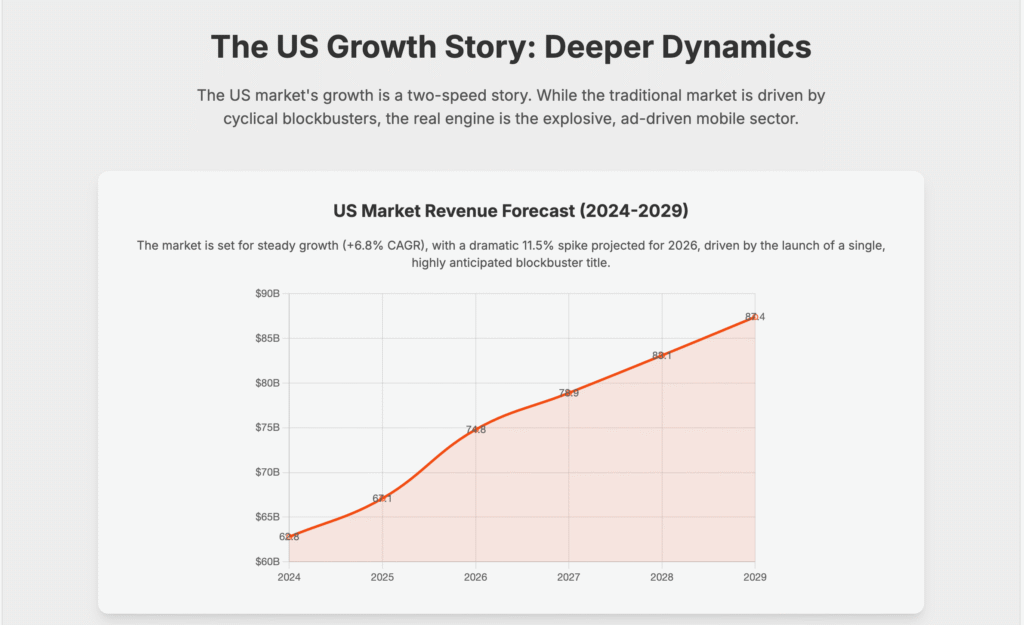

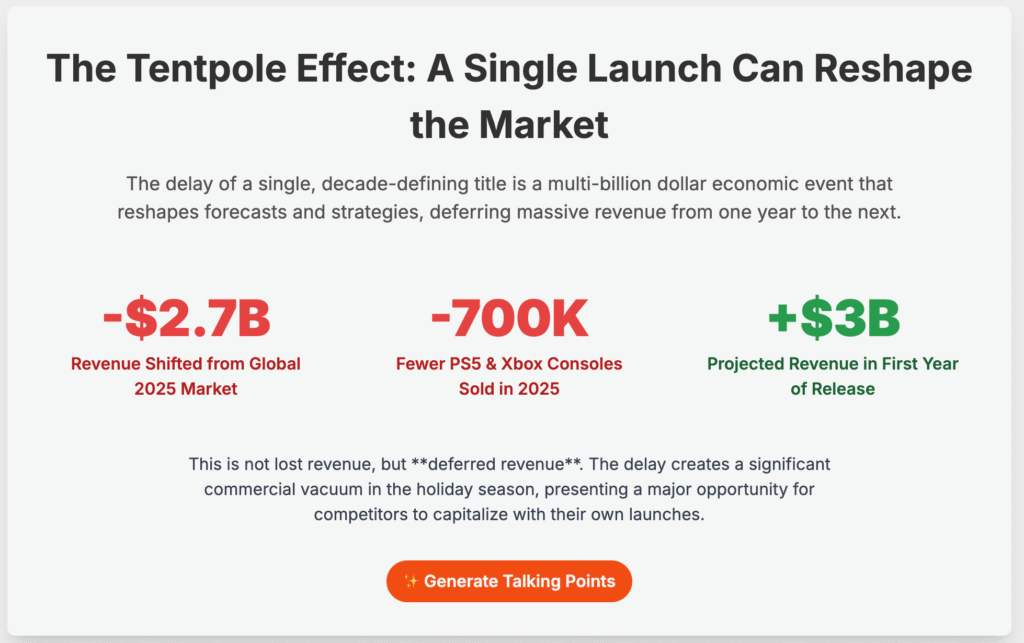

When you look at 2024 itself, the year-on-year growth in 2024 was 3.6%, a resumption in growth following a market contraction of -2.8% the previous year. Growth is expected to peak at 11.5% in 2026, before slowing steadily back to 3.6% by the end of the five-year forecast period.

PwC doesn’t talk about individual companies, but clearly the big deal in 2026 will be the May 2026 launch of Grand Theft Auto VI, coming from Take-Two Interactive’s Rockstar Games. Without saying names, PwC said that a single title’s delay has caused $2.7 billion in revenue to slip out of 2025 and it added $3 billion to 2026. One of the things that will make a difference is the expected $100 price tag for GTA VI, instead of $60 or $80.

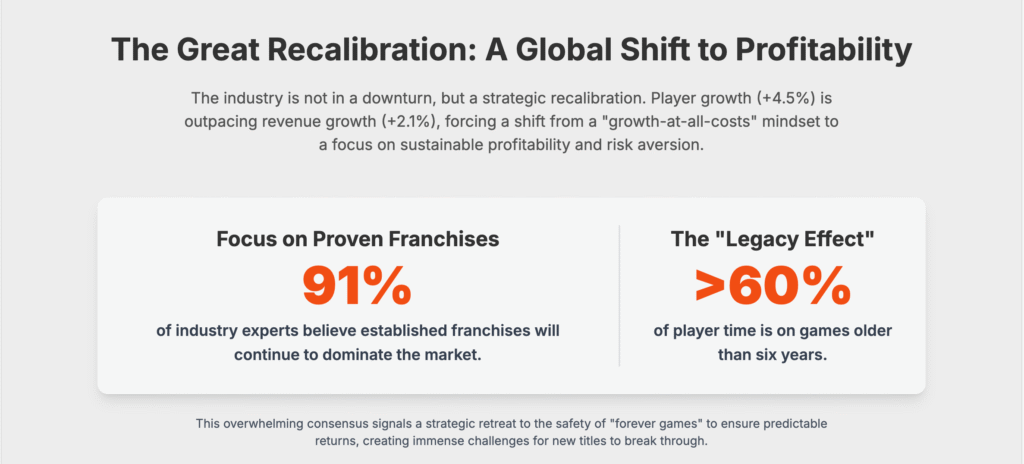

In 2024, the video game industry continued with the transformation era, with publishers and studios working to recalibrate their organizations to be more efficient, resulting in layoffs, studio closures, game cancellations, and delays, PwC said.

David Reitman, head of games at PwC, said in an interview with GamesBeat that the report is more optimistic than others because it takes into account the massive, underreported in-app advertising revenue engine that powers the U.S. ecosystem more than in other places in the world.

The enhancement of ads into games is creating a revenue inflection that basically causes our CAGR to look a little bit more aggressive than others. If memory serves me right, others are at sub 1% growth. Our CAGR is about 3.6% globally, Reitman said.

The trend in game advertising is that it is just starting to catch. Games advertising is now a very serious thing. No we’re seeing a lot of activity, Reitman said.

Game development has become much more complicated, which has caused reflections around return on investment (ROI) and a focus on the core vs. the speculative. Even the seasoned development projects were not immune.

On the cancellation side, publishers have cancelled Football Manager 2025 and XDefiant and closed numerous studios, including Tango Gameworks, Arkane, and Alpha Dog.

However, despite these recalibrations, there have also been some success stories, with Call of Duty: Black Ops 6 ranking as the best-selling game of 2024 and Black Myth: Wukong becoming the fastest-selling new IP game in recent history.

With the improvement in ad revenue, there’s a global shift to better profitability happening. PwC said the industry is not in a downturn, but it is in a strategic recalibration. Player growth of 4.5% is outpacing revenue growth, forcing a shift from a “growth at all costs” mindset to a focus on sustainable profitability and risk aversion.

It noted that 91% of industry experts believe that franchises will continue to dominate the market. They also say that 60% of player time is focused on games that are older than six years.

Of course, AI could change everything about the forecast.

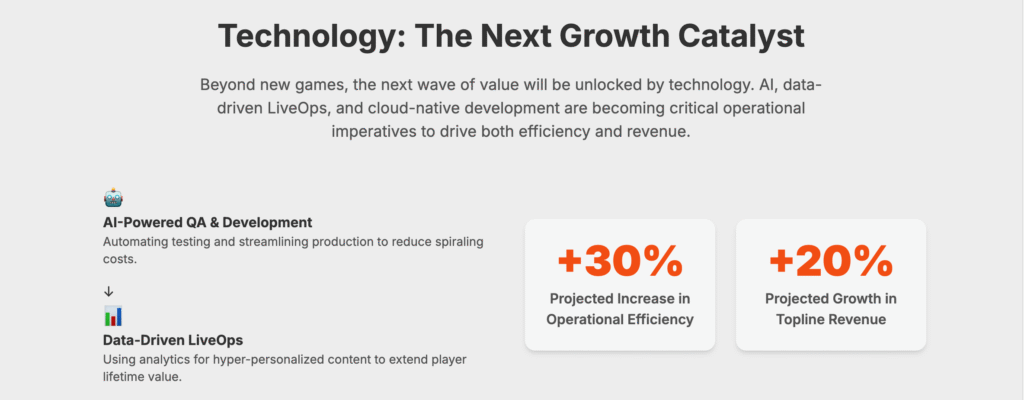

“AI is becoming super impactful as it relates to the development process. And I believe that the efficiencies are going to be very meaningful. We’re showing those efficiency gains to be in the neighborhood of 30% and I think that that’s somewhat conservative, but it’s helping everywhere that you can think that it can help,” Reitman said.

The result could be a more profitable industry, and that could lead to more jobs and move the jobs pendulum in the other direction, Reitman said.

“I don’t want to be absolute in my statements, but I am one of the more bullish people as it relates to AI,” he said.

As the market continues to change, game developers and publishers look to leverage emerging technologies that can assist in the cost reduction of game development and create hyper-personalized player engagement experiences.

Also, the larger social and casual gaming sector saw a robust return to growth last year and is expecting to see substantial gains in in-app advertising revenue across the forecast period, with the sector expected to expand by almost $20.0 billion in annual revenue in the next five years, PwC said.

Conversely, the traditional gaming sector, comprising revenues associated with PCs and games consoles, shrank for the second time within three years, precipitated by sharp declines in console gaming revenue. Traditional gaming is projected to perform substantially better in 2025 and 2026, thanks to expected and anticipated high-profile hardware and software launches. However, the sector’s remaining forecast period is forecasted to be minimal at best, with growth held back by the prospect of subscription services cannibalizing the revenue of PC and console games.

Additionally, the prospect of advertising within traditional games has the potential to represent an area of growth. However, because ads are minimally implemented within traditional core games and the player reaction is currently unknown, the prospect of revenue potential is somewhat unknown.

Mobile gaming

Social and casual gaming has long been the dominant sector within the U.S.’ video games market. In 2024 social and casual gaming generated $37.5 billion, equating to slightly over 60% of the country’s total video games revenue.

This market share has changed little in the last few years, but social and casual gaming is forecast to expand its presence across the forecast period. Over the next five years, social and casual gaming revenue will rise to $57.2 billion at a robust 8.8% CAGR, at which point the sector will represent 66.0% of US’ total video games revenue, PwC said.

The top-grossing mobile games in the U.S. in 2024 included familiar titles like Roblox, Monopoly Go!, Candy Crush Saga and Clash of Clans. Among these was one major breakout titles, namely Pokémon Trading Card Game Pocket, a digital version of the Pokémon card game, which has grossed more than $200 million since it launched in October.

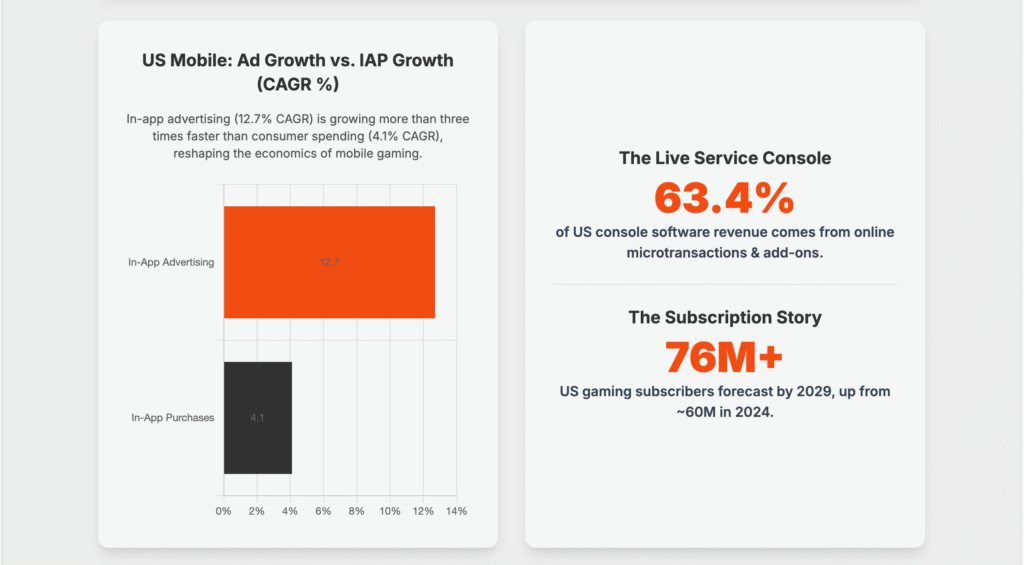

Growth in the social/casual sector is largely spurred by the rapid rise of in-app advertising revenue, which surpassed app-based social and casual gaming revenue in 2022 and maintained its lead in 2023 despite exhibiting negative year-on-year growth of -11.7%. In 2024 in-app advertising revenue witnessed a definitive return to growth at 10.5%.

The rise in in-app advertising reflects a shift in how mobile games are made and consumed. More game developers are intermixing in-game adverts with in-app purchases, and many companies are seeing the potential of in-game ads. In March 2024 the game engine developer Unity surveyed 300 game developers that use its game-creation toolkits, reporting that ad revenue was up 26.7% year-on-year, despite falls in both in-app purchases and player retention. Google has also seen the potential for serving ads in games, announcing at last year’s Google for Games Developer Summit that Google AdMob would begin serving in-game ads.

As such, 2025 is expected to be a strong year for in-app advertising in the US, with year- on-year growth of 24.1% propelling it far ahead of app-based social and casual gaming. While that growth rate is expected to slow considerably over the next five years, in-app advertising revenue will nonetheless exceed $35.2 billion by 2029 after increasing at a 12.7% CAGR. However, the development of the right strategy, hyper-personalisation,

to achieve these goals is paramount to access.

By comparison, the prospects for app-based social and casual gaming are far more modest. After experiencing negative year-on-year growth for two years running, app-based social and casual gaming returned to positive growth in 2024 at 3.7%, with revenue at $17.9 billion almost equalling its 2021 high. Although steady growth is expected across the forecast period, with app-based social and casual gaming revenue exceeding $21.9 billion after increasing at a 4.1% CAGR, these rates are unremarkable compared to in-app advertising. The contrast is particularly strong in 2025, where year-on-year growth of app-based social and casual gaming is expected to be just 1.6%.

There are various contributing factors to this. The market for in-game purchases could be approaching saturation in the U.S., with a 2024 report by Comscore stating that 82% of American gamers made an in-app purchase in free-to-play games in 2024. That same audience is also shifting to a preference for in-game adverts, as increased inflation and living costs mean that players are seeking cheaper ways to play games.

In the U.S. smartphone market, iOS retains the largest market share, with between 52 and 58% of American smartphone-owners using an iPhone as their primary device. In the gaming sphere, 2024 proved to be a mixed year for Apple. Its subscription video game service Apple Arcade continued to grow in popularity in the U.S., with an estimated 10% of U.S. consumers accessing Apple Arcade weekly. Meanwhile, Apple’s shift towards supporting more-demanding traditional games on the iPhone, like Assassin’s Creed Mirage and Resident Evil 4 remake, has met with a muted response. Current estimates indicate around 7,000 people paid to unlock the full version of Resident Evil 4 on iPhone within six months, and fewer than 3,000 people paid to play Assassin’s Creed Mirage on iPhone as of June 2024.

In 2025 we will reportedly witness some major changes to how Apple approaches the game-user experience on iOS, with the company said to be working on a new, game-focussed iOS app designed to centralise iOS users’ gaming experience, pulling in Live Services enabling players to view challenges and leaderboards as well as access the App Store and their game library all through one application.

It is also likely to be a significant year for Google. In October 2024 the tech giant was instructed to allow Android apps, storefronts and payment methods made by rival technology firms onto its Google Play Store, intended to open it up to increased competition. As a result of Epic Games’ successful lawsuit against Google, the changes were intended to come into effect on 1 November, but have since been paused while Google appeals against the decision. If the appeal fails, the changes could have significant ramifications for the global mobile app ecosystem.

Traditional gaming

Although the U.S. leans increasingly towards social and casual gaming, traditional gaming remains a notable part of its video games market. Indeed, at $23.1 billion in 2024, the U.S. has by far the largest traditional games market in the world, and it is expected to remain so across the forecast period, reaching $27.7 billion by 2029 after an increase at a 3.7% CAGR.

That said, 2024 has been a challenging year for the U.S.’ traditional gaming sector, with year-on-year revenue falling by -1.4%. This decline was triggered by reductions in sales of both digital and physical console games, with the former falling by -17.8% year-on-year and the latter dropping by almost one-third theoretically stating that traditional game players might be getting bored of the sequel rinse-and-repeat and desire new IP within

the traditional gaming domain. Nonetheless, both are expected to rebound over the next few years, although to varying extents and with different long-term consequences.

Console gaming

Despite being by far the largest source of traditional gaming revenue in the US, the console gaming market declined in 2024, with year-on-year revenue falling by just over -3.0%. While sharp declines in sales of physical and digital console games are the primary reasons for this, these declines are caused partly by a growing shift towards online/microtransaction revenue within US console gaming. At $11.0 billion, online/microtransaction revenue accounted for 63.4% of console gaming revenue in 2024.

This reflects the fact that traditional gaming revenue was delivered primarily by a handful of legacy titles in 2024, with relatively few new games managing to break into the upper echelons of the video game charts.

According to a report by Newzoo, more than 60% of consumer playing time in 2023 was dedicated to games more than six years old, chiefly long-running live-service games like Roblox, Minecraft, Fortnite and League of Legends. Meanwhile, the most-popular premium games are either sequels or games increasingly tied to live-service models, like Call of Duty, EA SPORTS FC and Grand Theft Auto V, the latter of which continues to be one of the U.S.’ bestselling games, despite being more than a decade old, thanks to how it facilitates access to Grand Theft Auto Online.

The popularity of these titles within traditional gaming makes it increasingly difficult for new premium games to compete. Compounding this challenge is stalling sales of the current generation of consoles (PlayStation 5 and Xbox One X), and subscription services like Xbox Game Pass and PlayStation Plus eating away at premium sales.

All that said, the performance of physical and digital console gaming cannot be attributed wholly to these entrenched heavyweight titles. The rising cost of premium gaming is also a factor. Both Xbox and PS5 consoles have remained at high price points throughout their lifespan, while many publishers have increased the recommended retail price of their games to $70 during this console generation. This is purportedly to combat soaring development costs, which often run into the hundreds of millions for modern blockbuster

games.

Yet many consumers have baulked at these prices, resulting in several underperforming games in 2024, like Ubisoft’s Star Wars: Outlaws and Square Enix’s Final Fantasy VII Rebirth, both of which retailed at $70, and sold below the expectations of their relative publishers. Compare this to games like Helldivers 2 and Black Myth: Wukong, which sold at $40 and $50 respectively. Helldivers 2 sold 12 million copies in its first three months on sale, while Black Myth: Wukong has sold 20 million copies to date.

Console gaming is expected to receive a significant boost in 2025, thanks primarily to a landmark launch that will add to a generally strong year for games. The Nintendo Switch 2 is expected to release in June 2025, following up Nintendo’s massively successful hybrid console, which in October 2024 officially supplanted Sony’s PlayStation 2 as the all-time biggest-selling console in the US. Furthermore, in May 2026, Rockstar Games is expected to launch Grand Theft Auto VI. With Grand Theft Auto V having sold over 200 million copies worldwide to date, its successor is expected to be comfortably the biggest launch of the year. Moreover, since Grand Theft Auto VI will initially be available only on PS5 and Xbox Series X and S as a premium title, it is likely to trigger a boost in sales of those consoles as well. However, Game Theft Auto VI is rumoured to have a price-point of $100 and based on the above, it will be interesting to see if Rockstar will be able to break the price-point ceiling and drive a successful outcome for the game.

PC gaming

While only a fraction of the total video games market, PC gaming nonetheless generates substantial revenue in the U.S. Total PC games revenue in the U.S. was $5.7 billion in 2024, and it is forecast to reach $6.6 billion by 2029 after increasing at a modest 2.9% CAGR. Sales of both digital PC games and online/microtransaction PC games revenue are growing at similar rates, although the latter is by far the larger revenue stream, generating nearly

85% of total PC games revenue.

The majority of PC games revenue in the US is generated by Epic Games and Valve, both of which own the most-notable distribution platforms on PC in the form of the Epic Games Store and Steam, and both of which develop several of the PC’s most-popular games, like Fortnite, Dota 2 and Counter-Strike 2. Consumers spent US$950mn on the Epic Games Store in 2023, around two-thirds of which was spent on first-party Epic titles (namely Fortnite, Rocket League and Fall Guys). Meanwhile, Valve is estimated to have earned $1.0 billion from Counter-Strike 2 in 2024, separate from the revenue it generates through Steam. With around 704mn game copies sold on Steam in 2024, Valve’s digital distribution platform is estimated to have generated $10.6 billion in revenue in last year, of which Valve takes a cut of between 20% and 30% depending on how much revenue the game in question creates.

Subscription gaming

Subscription gaming exhibits robust growth in the US. With revenue of $6.6 billion in 2024, cloud and subscription gaming revenue is expected to reach $9.9 billion by 2029, after an increase at a 8.4% CAGR. The U.S. has almost 60 million subscribers to services like Xbox Game Pass, PlayStation Plus and Apple Arcade, with this figure expected to rise to over 76 million by 2029, PwC said.

It was a significant year for Xbox Game Pass in 2024, with the service making Call of Duty: Black Ops 6 available to subscribers on launch following Microsoft’s successful acquisition of Activision Blizzard. The presence of Call of Duty on Game Pass is expected to provide a significant boost to subscriber numbers, and the extent of its effect will likely be a main factor in determining the shape of the service in the future.

Esports

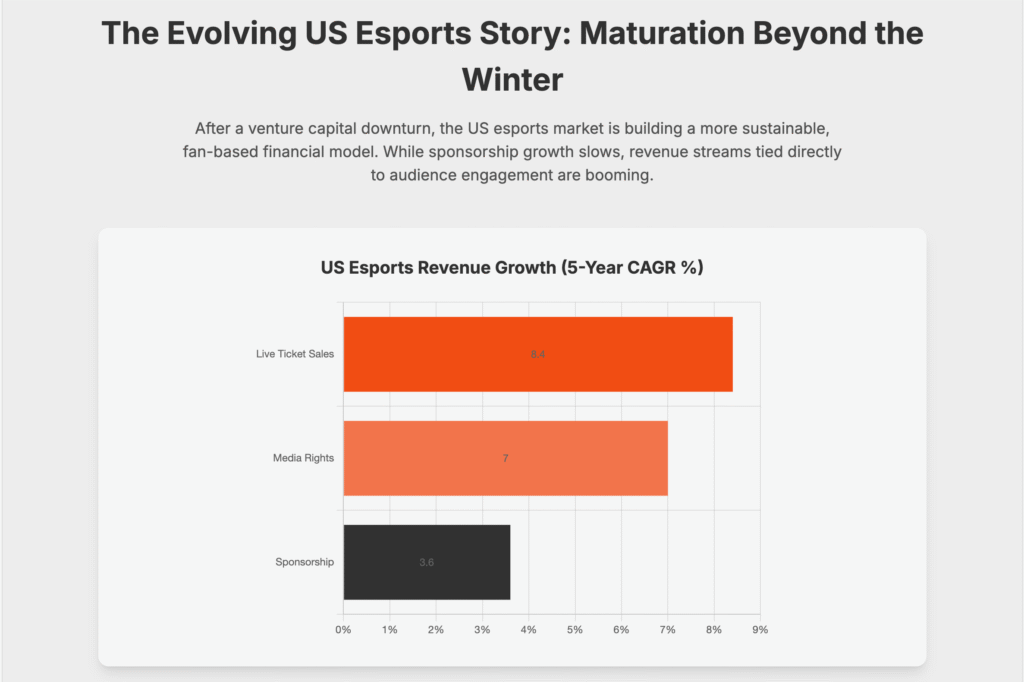

Total esports revenue in the U.S. totalled $523 million in 2024 and it is forecast to exceed $689 million by 2029 after increasing at a 5.7% CAGR. Year-on-year growth in 2024 was 9.3% and growth will slow to just below 3.9% year-on-year by the end of the five-year forecast period.

The U.S. is the second-largest esports market in the world, behind only China. Although the revenue gap between the two is expected to widen, the U.S. still leads in the field of industry investment. The U.S. is home to the creators of most leading esports titles, including Riot Games (League of Legends, Valorant), Valve (Dota 2, Counter-Strike 2) and Activision Blizzard (Call of Duty, Overwatch and StarCraft II ). And it is likewise home to

many of the most successful esports teams, like TSM and 100 Thieves, and formerly FaZe Clan.

The U.S. was struck by the “esports winter”, experiencing a sharp downturn in investment across the esports industry. In the US there has been a sharp decline in investment and sponsorship in esports organisations, resulting in lay-offs, acquisitions of notable esports institutions like FaZe Clan and outright shutdowns, like the closure of esports organisation The Guard.

Esports sponsorship revenue in the U.S. exhibits the slowest growth rate of any territory. With an increase at just a 3.6% CAGR, sponsorship revenue is expected to rise from $189 million in 2024 to just over $225 million by the end of the forecast period. As such, game publishers and developers now view esports as a market cost vs. a growth engine and in the era of recalibration and transformation of the games industry has lost a lot of the

budgets to continue to drive esports into the growth engine that was once viewed by the industry.

This heralds a shift in the US esports market, with media rights revenue expected to overtake sponsorship as the leading revenue-generator within the forecast period. With a more-robust increase at a 7.0% CAGR, esports media rights revenue will rise from almost $166 million in 2024 to $233 million by 2029, overtaking sponsorship revenue in 2028.

Moreover, as broadcasters and advertisers take a greater interest in American esports, attendance at live esports events is likewise on the rise. Esports consumer ticket sales revenue is the fastest-growing sector of the US market and is expected to rise from $38 million in 2024 to over $57 million by 2029 at a 8.4% CAGR.

Technology

As for AR and VR, the sectors are pushing technology but they’re not yet at the maturity level that the industry would like to see it at, Reitman said. They’re not selling enough devices yet.

Online gaming originated when game developers lacked the opportunity to carry out their plans using commercial-off-the-shelf (COTS) software or technologies. Everything was customized so, and the operational approach used was sometimes varied game-to-game within the studio, leading to meaningful inefficiencies in the game development process.

The games industry is now seeking to cross the inefficiency chasm and turn toward cloud-native technologies stacks and consistent frameworks. Recent analysis reveals a movement toward centralizing and establishing consistency in engineering services methodologies and approaches to supporting game development.

Cloud services and standardised LiveOps frameworks have become essential to delivering and maintaining large-scale, cross-platform environments in real-time. Partnered with a LiveOps strategy to support DLC, in-game events, and dynamic monetization functionality, dynamic data insights by leveraging AI can provide developers with real-time feedback to support a data-driven content strategy. Additionally, data-driven trust and safety in support of moderation and behavioural analysis is desired in order to mitigate toxicity in order to provide a healthy gameplay environment for players, a hot-button with gamers worldwide.

Additionally, as games, game functions, and game mechanics have become larger and more complex, along with the need to rigorously test every element, function, and platform repeatedly as developers make changes throughout the game development process, it has become cost-prohibitive to continually deploy larger teams to handle the testing workloads. As such, game developers have begun to turn to technology for a solution.

As Xbox’s Matt Booty mentioned in a 2022 Forbes interview, “Some of the processes we have have not really kept up with how quickly we can make content. One of those is testing. Help me figure out how to use AI to test a game.”

Automated tests and AI-based test solutions show promise in addressing this challenge. These solutions can automate various tests, including code-based unit tests, regression tests, platform certification and compliance tests, and gameplay tests, to name a few. We believe that this technology could reduce testing costs by at least 20%.

Lastly, the most meaningful way to solve inefficiency is through standardised frameworks and unified pipelines by leveraging data-driven LiveOps and trust and safety services with the transformation of QA with AI-driven solutions. Also, there is a massive opportunity to transform player engagement methodologies by leveraging hyper-personalization-enabling technologies.

Our research indicates that a comprehensive approach within these five areas can increase operational efficiency by at least 30% and grow topline revenue by at least 20%.