Among the major brand advertisers, relatively few grocery product advertisers have moved online to target female audiences. One reason is that there hasn’t been good data collected that tracks the tastes of women online.

Among the major brand advertisers, relatively few grocery product advertisers have moved online to target female audiences. One reason is that there hasn’t been good data collected that tracks the tastes of women online.

That’s why NeoEdge Networks, which operates an ad network for in-game advertising for casual games, is launching its NeoMOM demographic measurement tool today. The company will survey users across its network and issue reports every month so that advertisers can learn things such as what toothpaste women buy and what influences their purchases.

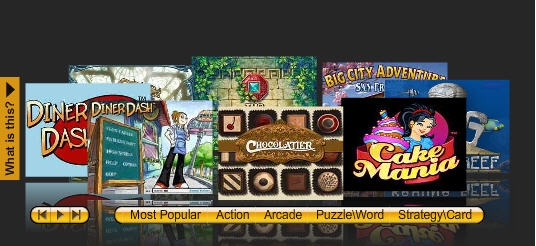

NeoEdge inserts video ads into games that players download from web sites. It has found that roughly 70 percent of players are adult women ages 24 to 54. That’s a highly desirable group for advertisers in the consumer products category. While the company can collect data on all gamers, it called the tool NeoMOM because mothers have a lot of clout in consumer purchases and advertisers want to reach them.

It will be interesting to see if advertisers respond as NeoEdge hopes. After all, there are other sites and ad networks on the Internet that directly target women — Glam, iVillage and Sugar — and these sites are capable of collecting data for advertisers too. But in this case, NeoEdge believes that it can get more accurate data more quickly because of reward systems built into the games. Basically, the surveys can be tied to games that people would normally pay for. If gamers are asked to fill out short surveys in exchange for some kind of discount on the game, they will likely do so. Another way to get gamers to fill out surveys is to reward them points for doing so, particularly if the points can be cashed in. Since gamers are motivated to play, they will put up with things that others who are just seeking information online won’t put up with.

Ty Levine, vice president of marketing at Mountain View, Calif.-based NeoEdge, said that the company has found that its online surveys have a higher response rate than usual, on the order of 8 to 9 percent, compared to average response rate of about 1 percent for online surveys. Hence, he believes that NeoEdge can produce detailed research inexpensively and share the results with brand advertisers.

NeoEdge isn’t going to sell the research. Levine believes the data will spur advertisers to spend more online to precisely target the audiences they want to reach. If, for instance, the data shows that a certain group of people aren’t aware of a brand, the advertiser can find a way to target that group and spend the necessary money to raise the awareness. That, in turn, should directly benefit NeoEdge, which gets a portion of the ad revenues that run inside online games. The first survey results will be available in mid January for advertisers.

Levine said that the data will complement what’s available from market researchers such as comScore, Nielsen, Quantcast and others. NeoEdge works with more than 50 game publishers to puts ads in games that are played by a community of more than 20 million people. There are more than 500 games in the network.

The company’s consumer audiences play for 45-minutes a session, an average of three times a week. In any given session, NeoEdge shows about six video ads to the players. Through the use of quick polls and “polls of the week,” the company has a chance to get opinions quickly from the participants.