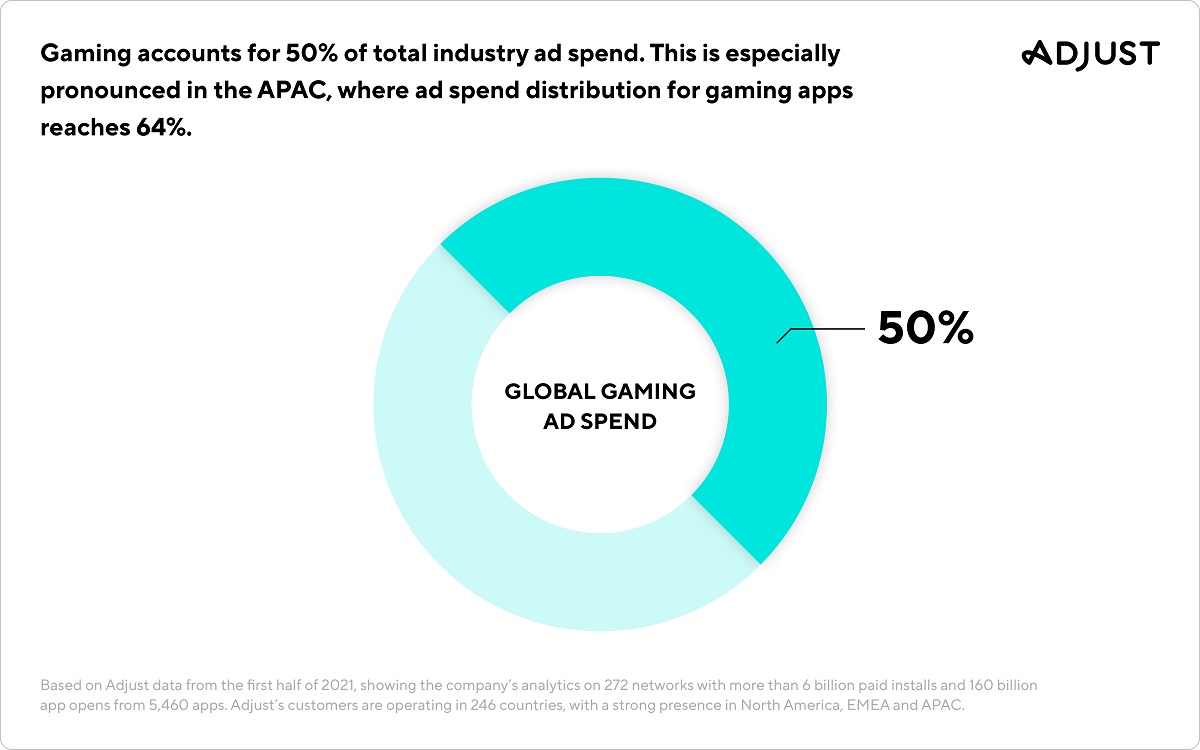

Gaming remains the largest category for user acquisition on mobile devices — accounting for 50% of all user-acquisition ad spending — according to mobile marketing analytics platform Adjust.

To put gaming’s 50% share of user-acquisition ad spending into perspective, the second-place vertical (e-commerce) makes up just 16%. This is especially pronounced in the Asia Pacific region, where ad spend distribution for gaming apps measured by Adjust reaches as high as 64% (followed by publications at 11%). In North America, that number reaches 57% (followed by fintech at 14%), and in Europe, the Middle East, and Africa, it sits at 39% (followed by e-commerce at 27%).

Unlock premium content and VIP community perks with GB M A X!

Join now to enjoy our free and premium membership perks.

![]()

![]()