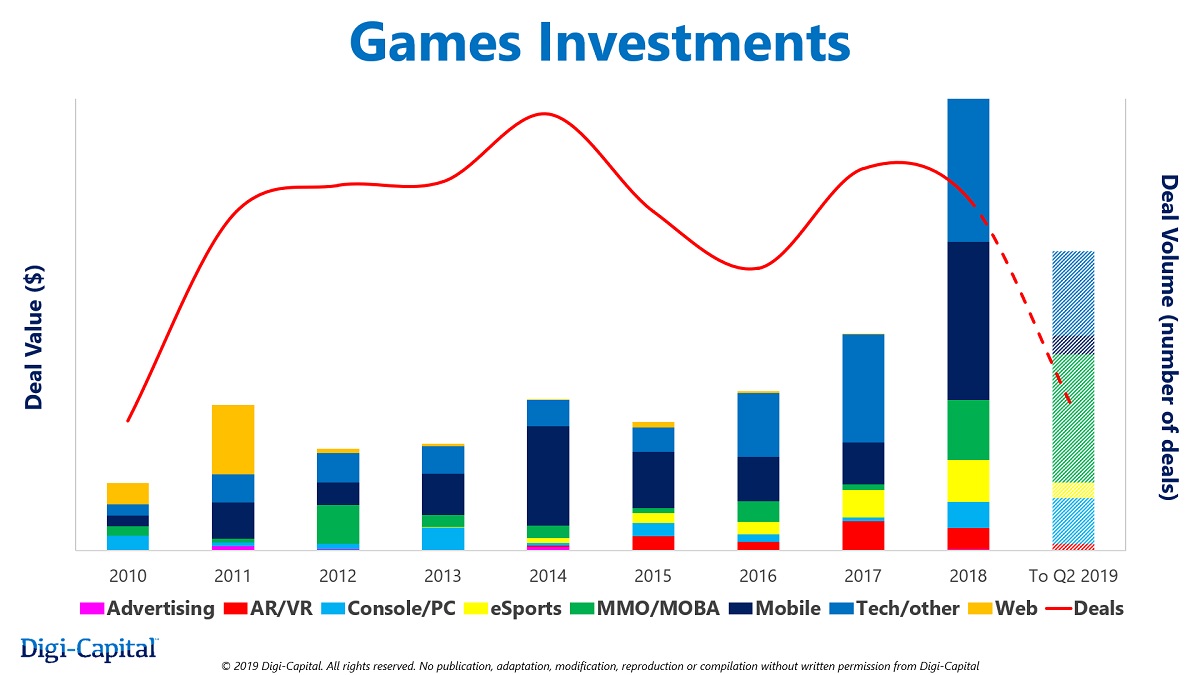

Investors poured $9.6 billion into game companies in past 18 months, but acquisitions and initial public offerings (IPOs) dropped to levels not seen since 2010, according to tech advisory firm Digi-Capital and its new Games Investment Report Q3 2019.

The report shows that after a record $5.8 billion games investment in 2018, venture capital and strategic games investors poured another $3.8 billion into games companies in the first half of 2019.

Unlock premium content and VIP community perks with GB M A X!

Join now to enjoy our free and premium membership perks.

![]()

![]()