Rixty has a system that lets kids and other gamers turn in their coins at stores and then get credits that they can spend in online games. Today, the company says that more than 50 companies have signed up to integrate its alternative payment method into games.

Rixty has a system that lets kids and other gamers turn in their coins at stores and then get credits that they can spend in online games. Today, the company says that more than 50 companies have signed up to integrate its alternative payment method into games.

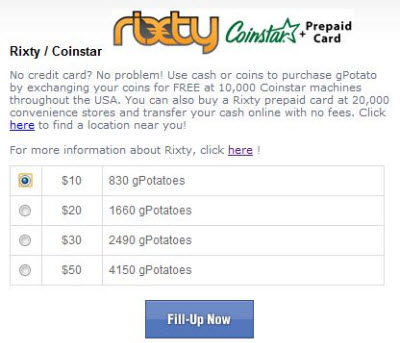

With Rixty, you can break that piggybank and take your coins or cash to 20,000 locations such as Coinstar coin-counting machines in grocery stores. The machines count your coins and give youcredit (via a 16-digit pin code) to spend on games. So far, Rixty’s users are spending an average of $30 a month on games. The users spend about $28 a month for games on Facebook. About 75 percent of Rixty users fund their accounts within 24 hours of creating it.

The users are also sticking around. Users who started in July, 2009, are still spending $30 a month. The average age of the Rixty users is 26, and 70 percent of the users say they do not have a credit card. Ted Sorom, chief executive of San Francisco-based Rixty, says that with the greater restrictions on the issuance of credit cards, online game publishers need to be flexible about allowing alternative means of payment.

With 50 partners in place, Rixty users can use cash and coins to pay for hundreds of massively multiplayer online games, virtual worlds, Facebook games and casual games on web sites. Consumers can use that Rixty cash across multiple online partners. Partners include Bigpoint, Gameforge, Fish Wrangler, Gala-Net, OMGPOP, Wicked Interactive, Roiworld, Altus Online, and Blue Frog Gaming.

The company was founded in 2007 and is funded by First Round Capital, Accelerator Ventures and Javelin Venture Partners. Rixty has fewer than 10 employees. Rivals include makers of prepaid cards such as InComm. In January, the company announced a $1.24 million seed round.